29 Oct USDINR Exchange Rate: Live Forex Updates

The USDINR exchange rate affects over $12 billion in daily trading volume1. This huge sum highlights why real-time forex rates matter so much. Staying informed is key in the fast-paced currency market.

The USDINR pair is a major player in forex trading. It moves within a range, similar to other big currencies. Ethereum, for example, now trades between $2,300 and $2,8001.

Financial markets can be quite unpredictable. Knowing these market shifts helps traders make smarter choices. It’s vital to watch global economic events closely.

US Federal Reserve policies greatly affect currency rates. Indian economic indicators also shape USDINR trends. These factors create both risks and chances for traders.

Key Takeaways

- USDINR exchange rate affects billions in daily trading volume

- Real-time forex updates are crucial for informed trading decisions

- Global economic events impact USDINR rates

- US Federal Reserve policies influence currency movements

- Indian economic indicators play a vital role in USDINR trends

- Market volatility creates both risks and opportunities

Understanding the USDINR Currency Pair

USDINR is a key forex pair. It shows the exchange rate between US dollars and Indian rupees. This pair is crucial for trade and investments between the US and India.

What is USDINR?

USDINR stands for the US dollar to Indian rupee exchange rate. It tells how many rupees you need for one US dollar. For instance, if USDINR is 75, you’d need 75 rupees to buy one dollar.

Factors Influencing USDINR Exchange Rates

Several factors affect the usd to inr exchange rate:

- Economic indicators of both countries

- Interest rate differentials

- Political stability

- Trade balances

- Foreign investment flows

India’s economic growth is set to slow to 6.9% this fiscal year. This is slightly lower than the IMF’s 7% forecast2. Such economic changes directly impact the rupee-dollar rate.

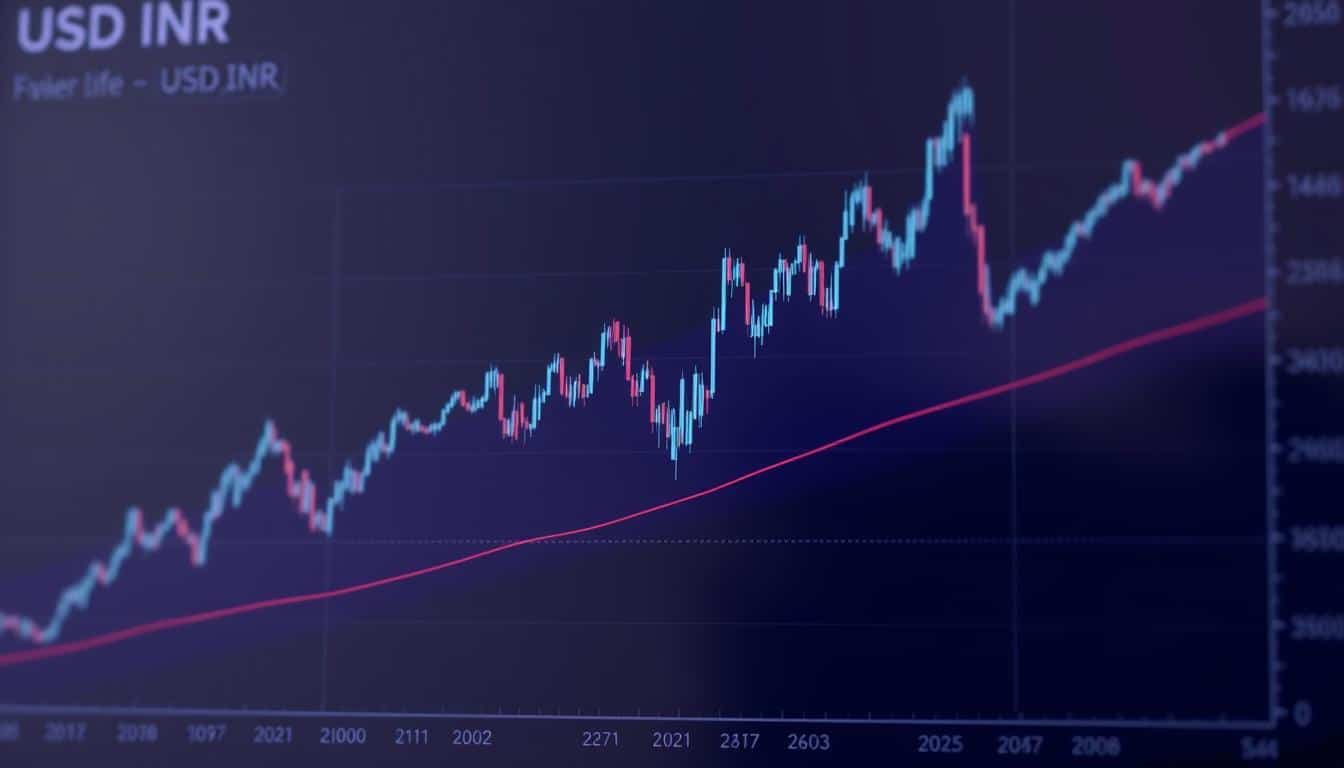

Historical Perspective of USDINR

The USDINR pair has seen big changes over time. In recent years, the rupee has mostly lost value against the dollar.

Experts predict India’s growth will drop to 6.7% next year. It may further decrease to 6.6% in FY 2026/272. These changes could affect future exchange rates.

| Year | Average USDINR Rate | Notable Events |

|---|---|---|

| 2020 | 74.11 | COVID-19 Pandemic |

| 2021 | 73.93 | Economic Recovery |

| 2022 | 77.53 | Global Inflation Concerns |

Knowing these factors is key for effective USDINR forex trading. Traders should keep up with economic forecasts. For example, India’s growth is expected to hit 7% this quarter and the next2.

Current USDINR Exchange Rate Trends

Rupee dollar conversion is a hot topic in currency markets. Recent exchange rate changes have caught traders’ and economists’ attention. The USDINR pair shows high volatility, reflecting dynamic global economic conditions.

The rupee has slowly lost value against the dollar this month. This is mainly due to external factors affecting emerging market currencies. Foreign investment flows greatly impact the current USDINR exchange rate.

| Time Period | USDINR Rate | Percentage Change |

|---|---|---|

| 1 Week | 82.65 | +0.3% |

| 1 Month | 82.20 | +0.8% |

| 3 Months | 81.75 | +1.5% |

The table shows a steady rise in USDINR rates over time. This suggests ongoing pressure on the rupee amid global economic uncertainty.

Experts are watching key economic indicators closely. These include inflation rates, GDP growth forecasts, and trade balance figures. The Reserve Bank of India’s actions also help stabilize the rupee’s value.

Market players must stay alert as global events unfold. US Federal Reserve policies and trade relations can impact the USDINR exchange rate3.

Impact of Global Economic Events on USDINR

Global economic events shape the USDINR exchange rate. Knowing these influences helps you navigate forex rates better. Understanding the market can lead to smarter currency decisions.

US Federal Reserve Policies

Federal Reserve decisions greatly affect currency exchange markets. Interest rate changes can cause USDINR fluctuations. When the Fed raises rates, it often strengthens the dollar against the rupee.

Indian Economic Indicators

India’s economic performance directly affects the rupee’s value. Recent projections suggest a slight slowdown in India’s growth rate. The economy is expected to grow by 6.9% this fiscal year2.

Consumer spending, 60% of the economy, has shown recent growth. Rising inflation is causing households to cut food expenses. Many are using savings to manage costs2.

International Trade Relations

Trade relationships between India and its partners influence USDINR forex rates. Positive trade balances strengthen the rupee, while deficits can weaken it. Economic indicators from major trading partners also impact the currency pair.

| Economic Factor | Expected Trend | Potential Impact on USDINR |

|---|---|---|

| Job Creation | Mild Increase | Slight Rupee Strengthening |

| Private Consumption | Mild Increase | Potential Rupee Support |

| GDP Growth | Gradual Decline | Possible Rupee Weakening |

Experts predict mild increases in job creation and private consumption. These factors could support the rupee in the forex market2. However, gradual GDP decline might weaken it.

Staying informed about global economic events is crucial. It helps you understand potential impacts on the USDINR pair. This knowledge can lead to better currency exchange decisions.

Technical Analysis of USDINR

Technical analysis is key for understanding USD to INR exchange rate movements. Traders use charts, indicators, and patterns to make informed decisions. This helps them navigate the Rupee vs Dollar pair effectively.

Support and resistance levels are crucial in USDINR analysis. These act as barriers where price movement often pauses or reverses. Major support levels may be at previous lows, while resistance levels could be at previous highs.

Trend lines help identify the overall direction of the USD to INR rate. Upward trend lines connect higher lows, while downward ones link lower highs. Traders use these lines to spot potential entry or exit points.

Moving averages are popular indicators for Rupee vs Dollar analysis. The 50-day and 200-day averages are common choices. A bullish signal occurs when the shorter-term average crosses above the longer-term one.

The Relative Strength Index (RSI) helps gauge market conditions. An RSI above 70 might suggest overbought conditions, while below 30 could indicate oversold. These levels often precede potential reversals in the USDINR rate.

Combining these tools helps traders develop effective strategies. This approach allows for better navigation of the complex USD to INR forex market4.

Fundamental Factors Affecting Rupee vs Dollar

Key economic indicators shape rupee dollar conversion dynamics. Various factors influence currency markets in foreign exchange trading. These elements play a crucial role in determining exchange rates.

Indian GDP Growth

India’s economic performance greatly impacts the rupee’s strength. Last fiscal year, the country’s GDP growth hit an impressive 8.2%, outpacing other major economies2. This robust growth positively affects foreign exchange trading.

However, economists predict a gradual slowdown. Growth forecasts for the current fiscal year stand at 6.9%2. Subsequent years are expected to see 6.7% and 6.6% growth rates.

Inflation Rates

Inflation significantly impacts currency values in the forex market. Rising inflation in India can weaken the rupee against the dollar. Consumer spending, which makes up 60% of the economy, has recently increased.

However, growing inflation is affecting household savings. This may lead to a slowdown in consumption2.

Foreign Investment Flows

The influx of foreign investments greatly influences the rupee’s value. A positive economic outlook often attracts more foreign capital, strengthening the rupee. Job creation is expected to increase mildly over the next 12 months.

This prediction comes from 15 out of 28 respondents in a recent survey2. Such trends could potentially attract more foreign investments, impacting currency markets.

| Economic Indicator | Current Status | Future Outlook |

|---|---|---|

| GDP Growth | 8.2% (Last fiscal year) | Projected slowdown to 6.9% |

| Consumer Spending | Recent increase | Potential slowdown due to inflation |

| Job Creation | Stable | Mild increase expected |

USDINR Forex Trading Strategies

USDINR forex trading requires technical analysis and fundamental understanding. Traders use chart patterns and indicators to gauge market sentiment. The pair is influenced by economic data releases and global events.

A popular strategy involves tracking exchange rates during key economic announcements. The Reserve Bank of India’s decisions can cause volatility in USDINR forex rates. Traders use limit orders or breakout strategies to capitalize on these moments.

Risk management is vital when trading USDINR. Traders use stop-loss orders to protect against unexpected market swings. They also practice proper position sizing, risking 1-2% of their account per trade.

Trend-following strategies are effective for USDINR trading. Moving averages help identify long-term trends and entry points. This approach works well due to the pair’s tendency to form strong trends.

For broader insights, forex rates often correlate with global economic trends. Understanding these relationships can give traders a competitive edge in USDINR trading.

Successful USDINR trading requires patience, discipline, and continuous learning. Stay informed about Indian and US economic indicators for better trading decisions3.

Role of RBI in USDINR Exchange Rate Management

The Reserve Bank of India (RBI) manages the USD to INR exchange rate. It intervenes in forex markets to keep the rupee-dollar relationship stable5.

RBI Interventions

External factors trigger RBI interventions in the INR-USD rate. These include oil price changes, US Dollar shifts, and foreign investment fluctuations5.

The bank buys or sells foreign currency to smooth out exchange rate volatility. This helps maintain a balanced market environment.

Monetary Policy Impact

RBI’s monetary decisions greatly affect the USD to INR rate. Interest rate changes can influence foreign investment flows, impacting the rupee’s value5.

India’s growth is projected between 7.0% and 7.2% for 2024-25. This outlook may shape future monetary policies.

Foreign Exchange Reserves

The RBI uses foreign exchange reserves to control the rupee vs dollar rate. These reserves protect against external shocks and boost financial confidence.

Strategic use of reserves allows the RBI to intervene in the forex market when needed.

The rupee is sensitive to global events. Middle East tensions can affect oil prices, influencing the USD to INR rate6.

The RBI closely monitors these factors. It intervenes to balance exchange rate stability with economic growth.

USDINR and Its Impact on Indian Economy

The USDINR exchange rate shapes India’s economic landscape. It influences various sectors of the economy. Currency market fluctuations affect imports, exports, and overall economic growth.

India’s economic growth remains strong despite challenges. The unemployment rate stays steady at 3.2% in FY24. This shows some stability in the labor market7.

Rural demand is rising. FMCG volume sales are increasing. Purchases of three-wheelers and tractors are also up7.

The rupee’s value affects import costs and export competitiveness. A weaker rupee can make imports pricier. It can also boost exports by making Indian goods more attractive globally.

The Reserve Bank of India’s surveys suggest softening inflation expectations. This could influence future currency market trends.

Understanding USDINR dynamics is crucial for international businesses. Companies may need to adjust strategies based on exchange rates. Consumers feel the impact through changes in imported goods prices.

India’s gasoline demand is set to increase by 6% year-on-year in FY25. Diesel demand is expected to rise by 1.5%7. These forecasts show ongoing economic activity.

This growth potential could influence future rupee-dollar conversions. It may also affect foreign exchange trading patterns1.

Forecasting USDINR: Short-term and Long-term Outlook

USDINR exchange rates are influenced by economic projections, analyst insights, and technical indicators. Let’s explore the outlook for this important forex pair.

Economic Projections

India’s economic growth is expected to slow to 6.9% this fiscal year. This is slightly below the IMF’s 7% forecast2.

The growth trend is set to continue, with projections of 6.7% for the next fiscal year. For FY 2026/27, a 6.6% growth rate is anticipated2.

These figures point to a stable but gradually cooling economy. This could impact USDINR rates in the coming years.

Analyst Predictions

Experts are focusing on job creation and private consumption in India. Most analysts expect mild increases in both areas over the next year2.

These factors could strengthen the rupee against the dollar. As a result, we might see lower USDINR rates in the future.

Technical Indicators

USDINR technical analysis involves studying charts and patterns. The overall trend suggests caution for traders and investors.

Global economic events can cause sudden exchange rate changes. These include shifts in US Federal Reserve policies and international trade relations.

Traders should keep a close eye on these factors when making forex decisions. Staying informed is key to navigating the USDINR market.